Short Briefing

In the present high-speed world, managing your finances can be a challenge. Yet, with the right apparatuses, you can work on this task. Financial management apps can assist you with following spending, setting budgets, and saving proficiently. Android offers a few strong apps that can make this interaction more straightforward. Whether you’re attempting to set aside cash, manage investments, or create a budget, there’s an application for you. We should jump into the top five Android apps for managing your finances, each intended to assist you with keeping steady over your financial well-being.

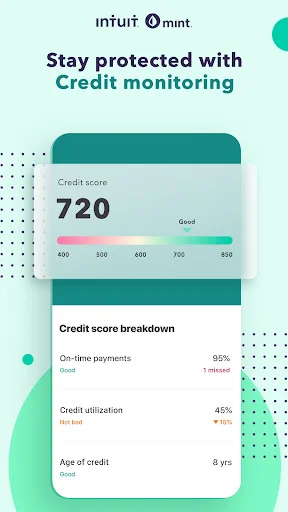

1. Mint: Budget, Bills, & Finance Tracker:

Mint is one of the most well-known financial management apps accessible on Android. It offers a complete answer for tracking your finances. The application permits you to interface your ledgers, Mastercards, and bills, giving you a full image of your financial circumstances. With Mint, you can undoubtedly screen your ways of managing money, put forth financial objectives, and get alarms for impending bills.

One of Mint’s champion elements is its budgeting instrument. It examines your spending designs and recommends a budget that accommodates your way of life. You can likewise make custom classes to track explicit costs. Furthermore, Mint gives financial tips given your ways of managing money. Whether you’re putting something aside for a major buy or simply attempting to remain within budget, this application assists you with settling on better financial choices.

For those worried about security, Mint proposes various layers of encryption to safeguard your data. This guarantees that your financial data stays safe. The application is allowed to download, however, there are top-notch choices for added highlights.

Key Features:

- Real-time account synchronization

- Budget creation and management tools

- Alerts for bills and unusual account activity

- Custom spending categories

- Financial tips based on spending habits

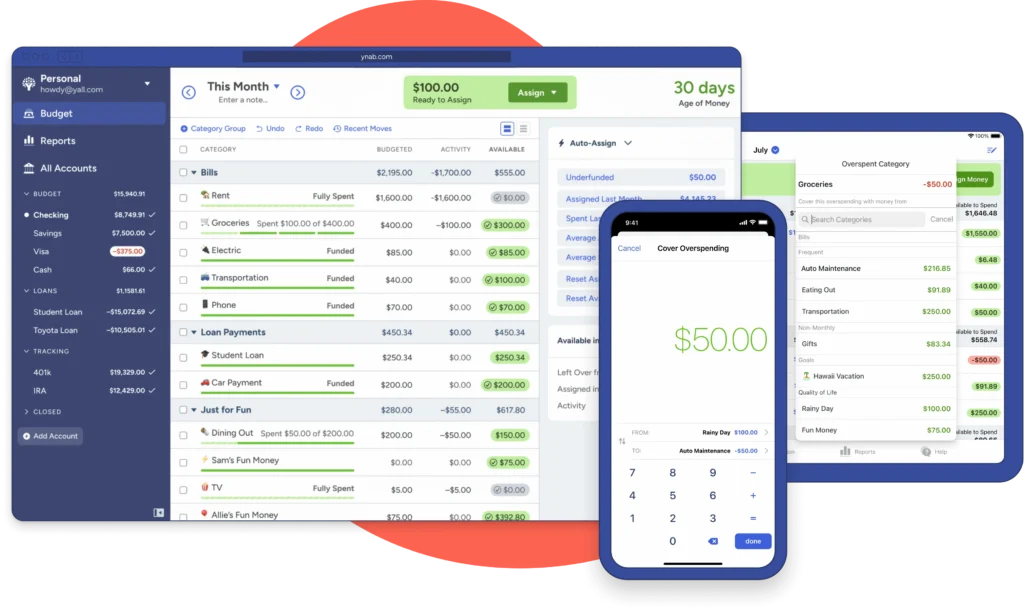

2. YNAB (You Need A Budget)

YNAB, short for You Want A Budget, is another top-indent application intended for those focused on managing their finances. It offers an alternate methodology contrasted with Mint. Rather than tracking past spending, YNAB centers around future budgeting. The application follows the way of thinking that each dollar ought to have some work, assisting you with focusing on your cash for things that make the biggest difference.

With YNAB, you physically input your pay and designate it towards explicit costs. This proactive methodology urges you to remain reasonably affordable for your restrictions. The application likewise offers instructive assets, like financial studios, to further develop your cash management abilities. Dissimilar to other apps’, YNAB will probably assist you with breaking the check-to-check cycle.

However YNAB is a paid application, and its outcomes frequently legitimize the expense. Numerous clients report saving huge sums inside the initial not many long stretches of utilizing the application. The connection point is instinctive, and YNAB adjusts across all gadgets, so you can manage your finances whenever anywhere.

Key Features:

- Future-focused budgeting

- Customizable budget categories

- Syncs with multiple devices

- In-depth financial workshops and resources

- Focus on breaking paycheck-to-paycheck cycle

3. PocketGuard: Budget, Track & Save:

If you’re searching for a simple method for controlling your finances, PocketGuard is an extraordinary choice. The application rearranges budgeting by showing you how much cash you have accessible after representing bills, investment funds objectives, and necessities. This “In My Pocket” highlight assists you with abstaining from overspending by providing you with an unmistakable image of your extra cash.

PocketGuard consequently orders your exchanges and permits you to track different financial balances. It additionally offers apparatuses to assist you with bringing down your bills by distinguishing more ideal arrangements on administrations like protection or phone plans. The application even has an element that tracks your memberships, guaranteeing you’re not paying for administrations you never again use.

PocketGuard is ideal for individuals who need a basic, clear way to deal with managing their cash. The application is allowed to be utilized, however, a top-notch variant is accessible that offers further developed highlights, for example, adaptable classifications and point-by-point spending reports.

Key Features:

- “In My Pocket” feature for disposable income tracking

- Automated transaction categorization

- Subscription tracking tool

- Bill comparison and savings suggestions

- Free and premium versions available

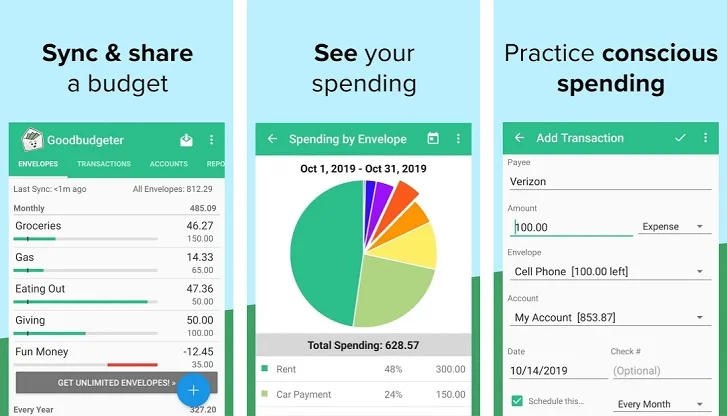

4. Goodbudget: Budget & Finance:

Goodbudget is great for individuals who lean toward the envelope budgeting framework. The application permits you to distribute your pay into virtual envelopes, each addressing a particular spending classification. This technique assists you with imagining your budget and guarantees you overspend in no space.

Goodbudget doesn’t match up with your financial balances; all things being equal, you physically input your exchanges. This makes it an additional involved application yet additionally offers more noteworthy command over your budget. Ideal for those who like to remain effectively drawn in with their finances.

Furthermore, Goodbudget offers the capacity to impart your budget to an accomplice or relative, making it incredible for managing shared costs. The application is accessible for nothing, yet an exceptional variant gives more envelopes and highlights.

Key Features:

- Virtual envelope budgeting system

- Manual transaction input for greater control

- Ability to share budgets with partners

- Great for tracking shared expenses

- Free and premium versions available

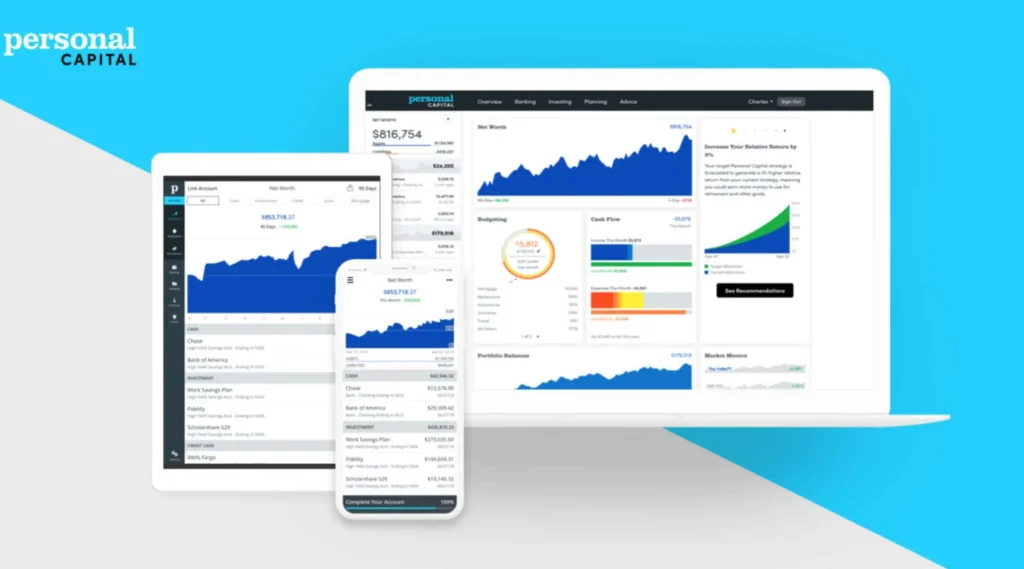

5. Personal Capital: Investing & Finance:

Personal Capital is the ideal application for those keen on budgeting and financial planning. It consolidates financial tracking apparatuses with hearty investment management highlights. The application allows you to screen your income, track your total assets, and examine your investment portfolio, across the board place.

Personal Capital interfaces with all your financial records, including ledgers, charge cards, credits, and investment accounts. This provides you with a total outline of your financial well-being. The application likewise offers point-by-point cover for your investments, assisting you with spotting potential open doors for development or areas of chance.

For those hoping to develop their riches, Personal Capital additionally gives financial arranging administrations. While certain highlights are free, there are paid administrations that offer additional personalized investment exhortation from financial consultants.

Key Features:

- Comprehensive financial overview, including investments

- Detailed reports on investment performance

- Net worth tracking

- Integration with all financial accounts

- Paid services for personalized financial advice

Benefits of Using Finance Apps:

- These apps assist you with overseeing your ways of managing money.

- By tracking each cost, you’re more averse to overspending.

- Moreover, they make budgeting easier.

- Rather than physically making a budget, these apps do the hard work by examining your pay and costs.

- Additionally, financial apps give constant data on your financial well-being.

- Whether it’s a notice about a forthcoming bill or a caution on uncommon spending.

- You’ll remain informed.

- This continuous access is pivotal in settling on more brilliant financial choices.

- For those zeroed in on long-haul financial objectives, like saving or effective money management, these apps offer devices that assist you with remaining focused.

- You can define explicit reserve funds objectives, track progress, and even get personalized tips.

- In particular, financial apps are helpful.

- With everything in one spot, managing your finances has never been more straightforward.

How to Choose the Right App?

- Picking the right financial management application relies upon your objectives.

- On the off chance that you want a general budgeting device, Mint or PocketGuard might be the most ideal choice.

- They offer simple-to-utilize connection points and complete tracking apparatuses.

- In any case, if you’re centered around long-haul financial preparation or money management, Personal Capital is the better decision.

- For the people who lean toward involved control of their budget, YNAB and Goodbudget offer more customized budgeting frameworks.

- They require more manual info however give you full command over your finances.

- Finally, think about security.

- All the apps referenced here are major areas of strength for offer and security highlights.

- However, it’s consistently vital to explore further before adjusting delicate financial data.

Recommended: Top 5 Free Android Apps for Learning New Skills

Conclusion

Managing your finances doesn’t need to be troublesome. With the right Android application, you can track your spending, make a budget, and even develop your riches. Each application referenced here has exceptional elements, so finding the one that accommodates your way of life is critical. Whether you’re simply beginning to make heads or tails of your budget or hoping to advance your investments, there’s an application intended for you. Begin assuming command over your financial future today by picking the application that best addresses your issues.